Last updated: 17 November 2025 | Change log

A secure and globally accepted direct debit.

Make yourself familiar with our API Principles to ensure a resilient integration.

Product overview

SEPA Direct Debit is an easy way to take bank payments from your customers, using an IBAN (International Bank Account Number).

The SEPA Direct Debit scheme is a set of rules that dictate how payments must be processed and settled in the SEPA (Single Euro Payment Area) region. As part of these rules, you must create an e-Mandate with your customer to consent to payments.

| Payment type | Acceptance currency | Recurring | Reverse | Partial Reverse | Disputes |

|---|---|---|---|---|---|

| Bank Transfer | EUR (Euro) | ❌ |

|

| ✅ |

- Austria

- Belgium

- France

- Germany

- Ireland

- Italy

- Netherlands

- Spain

Each SEPA Direct Debit e-Mandate must have its own unique mandate identifier (mandateId). When your customer makes a SEPA Direct Debit payment they are redirected to our Hosted Payment Pages (HPP). There, the mandate is created, and your customer enters their payment details. The mandateId is created by us in the following format:

- W-MERCHANTNUMBER-RANDOMCHARACTERS - Example: W-123456789-A79ZH34KJZ

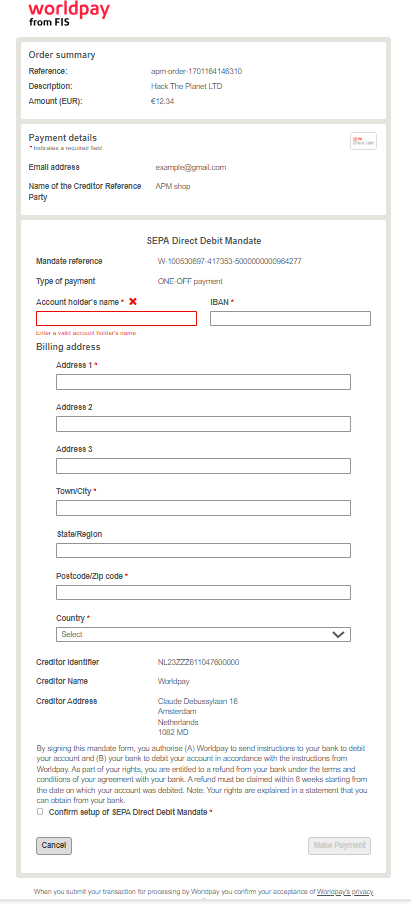

Below is an example of our Hosted Payment Page that captures your customer's payment information and creates a mandate:

To get the most from SEPA Direct Debit, refer to our best practices and recommendations.

| Language | Code |

|---|---|

| Dutch | nl |

| English | en |

| French | fr |

| German | de |

| Italian | it |

| Spanish | es |

Setting your headers is an important part of an API request. The headers represent the meta-data associated with your API request.

Authorization: {your_credentials}

Content-Type: application/json

WP-Api-Version: 2023-06-01| Header | Description |

|---|---|

Authorization | We use the Authorization header to identify and authenticate you within Access Worldpay. You must use the Authorization header for any request you send to our APM API. |

Content-Type | We require the Content-Type header if the request you're sending includes a request body, and if the HTTP method is a POST or a PUT. |

WP-Api-Version | We use the WP-Api-Version header to identify which version of our APM API you are using. You must use the WP-Api-Version header for any request you send to our API. |

If you're using both the Content-Type and WP-Api-Version headers, they must match.

Replace {your_credentials} with your base64-encoded Basic Auth username and password. To get your Access Worldpay credentials contact your Implementation Manager.

POST https://try.access.worldpay.com/apmPayments

{

"transactionReference": "Memory265-13/08/1876",

"merchant":

{

"entity": "default"

},

"instruction":

{

"narrative":

{

"line1": "Mind Palace LTD"

},

"value":

{

"amount": 1234,

"currency": "EUR"

},

"paymentInstrument":

{

"type": "sepa",

"country": "DE",

"language": "de",

"shopperEmailAddress": "email@example.com",

"mandateType": "onetime",

"successURL": "https://example.com/success",

"pendingURL": "https://example.com/pending",

"failureURL": "https://example.com/failure",

"cancelURL": "https://example.com/cancel"

}

}

}| Parameter | Required? | Description | Data type | Length |

|---|---|---|---|---|

merchant | ✅ | An object that contains information about the merchant. | Object | N/A |

merchant.entity | ✅ | Direct your payment to assist with billing, reporting and reconciliation. This is mandatory for Authentication and Queries. Contact your Implementation Manager for more details. | String | Must be between 1 and 32 characters. |

transactionReference | ✅ | A unique reference generated by you that is used to identify a payment throughout its lifecycle. See transaction reference format. | String | Must be between 1 to 64 characters. |

instruction | ✅ | An object that contains all the information related to the payment. | Object | N/A |

instruction.narrative | ✅ | An object that helps your customers better identify you on their statement. | Object | See our formatting rules |

instruction.narrative.line1 | ✅ | The first line of the narrative which appears on your customer's statement (If a character is not supported it is replaced with a space.). See narrative line1 format for more details. | Object | 24 |

instruction.value | ✅ | An object that contains information about the payment transaction. | Object | N/A |

instruction.value.currency | ✅ | The payment currency. Refer to the individual APM page for supported currencies. | Integer | 3 |

instruction.value.amount | ✅ | The payment amount. This is a whole number with an exponent e.g. if exponent is two, 250 is 2,50. You can find the relevant exponent in our currency table. | Integer | N/A |

instruction.paymentInstrument | ✅ | An object that contains information about the payment method. | Object | N/A |

instruction.paymentInstrument.type | ✅ | An object that contains the payment type and details. It defines which alternative payment method you wish to use. For SEPA Direct Debit the value is "sepa". | Object | N/A |

instruction.paymentInstrument.country | ❌ | An object that contains the country of your customer. Follows alpha 2 ISO 3166-1 standard. | Object | 2 |

instruction.paymentInstrument.language | ❌ | An object that contains the language of your customer. Follows ISO 639-1 standard. | String | 2 |

instruction.paymentInstrument.shopperEmailAddress | ✅ | The email address of your customer. | String | N/A |

instruction.paymentInstrument.mandateType | ✅ | Must be set to “onetime” | String | N/A |

instruction.paymentInstrument.cancelURL | ❌ | When your customer cancels a transaction, we redirect your customer to that cancel URL. | String | N/A |

instruction.paymentInstrument.failureURL | ❌ | When a payment fails, we redirect your customer to the failure URL. | String | N/A |

instruction.paymentInstrument.pendingURL | ❌ | When we receive the payment result for a pending payment transaction, we redirect your customer to that pending URL. | String | N/A |

instruction.paymentInstrument.successURL | ❌ | When we receive the payment result for a successful payment, we redirect your customer to that success URL. | String | N/A |

cancelURL,failureURL, pendingURL and successURL attribute to redirect your customer to, once you have received the payment result. - an HTTP code

201 - an

idwhich is unique to the payment - we recommend storing the "id" as this can be used to manage the payment later - a

urlto redirect your customer to the APM provider to complete the payment - a link to query the payment status

{

"paymentId": "nFxASqw-LV9HE_rr1mMONJmqBDeXmnv5dzt9IxAXgXbfpu0O_8mOnTpFSIM9gnTSygCKQgvlwQdUbu5rExIpJA_5Uq2LEGXXAanycRpxfDPNA-E70zIWdnaMb2gJhC8AIhbOkM6xDiVNu90YCXo2snTzi_k1sEOQnKIAJNTW3Qc",

"lastEvent": "pending",

"_links": {

"self": {

"href": "https://access.worldpay.com/apmPayments/nFxASqw-LV9HE_rr1mMONJmqBDeXmnv5dzt9IxAXgXbfpu0O_8mOnTpFSIM9gnTSygCKQgvlwQdUbu5rExIpJA_5Uq2LEGXXAanycRpxfDPNA-E70zIWdnaMb2gJhC8AIhbOkM6xDiVNu90YCXo2snTzi_k1sEOQnKIAJNTW3Qc"

}

},

"_actions": {},

"url": "https://payments.worldpay.com/app/hpp/integration/wpg/corporate?OrderKey="

}In case of an error, you can get further information in our error reference.

Next steps